nfa tax stamp trust vs individual

Sure you can transfer your individually registered items to a trust but the process is no different. In fact you can buy NFA Firearms just about anywhere.

How To Sell Your Used Silencer

It requires some simple legal paperwork that you can have your local lawyer draw up for you or you can use an online Trust-building resource.

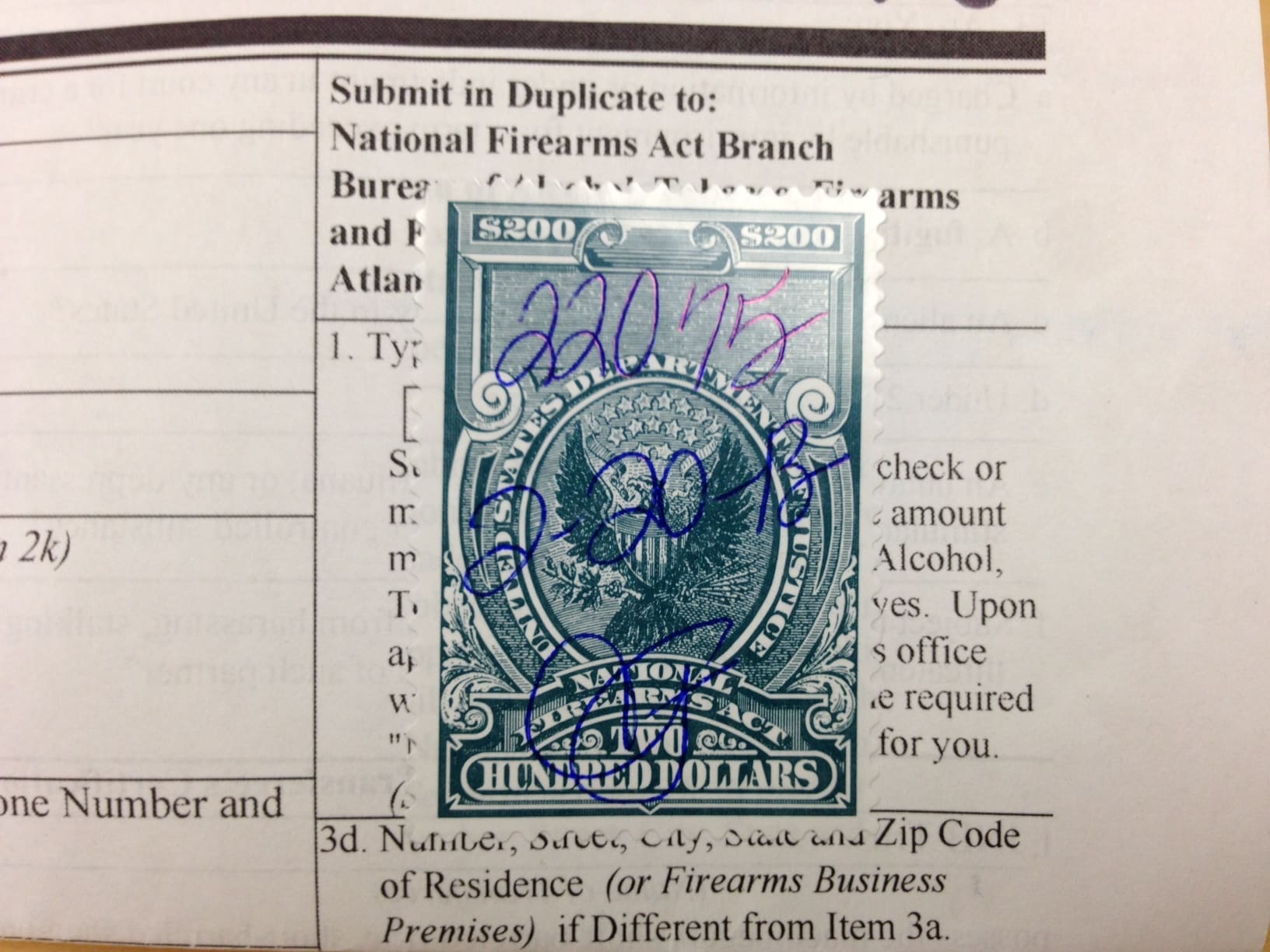

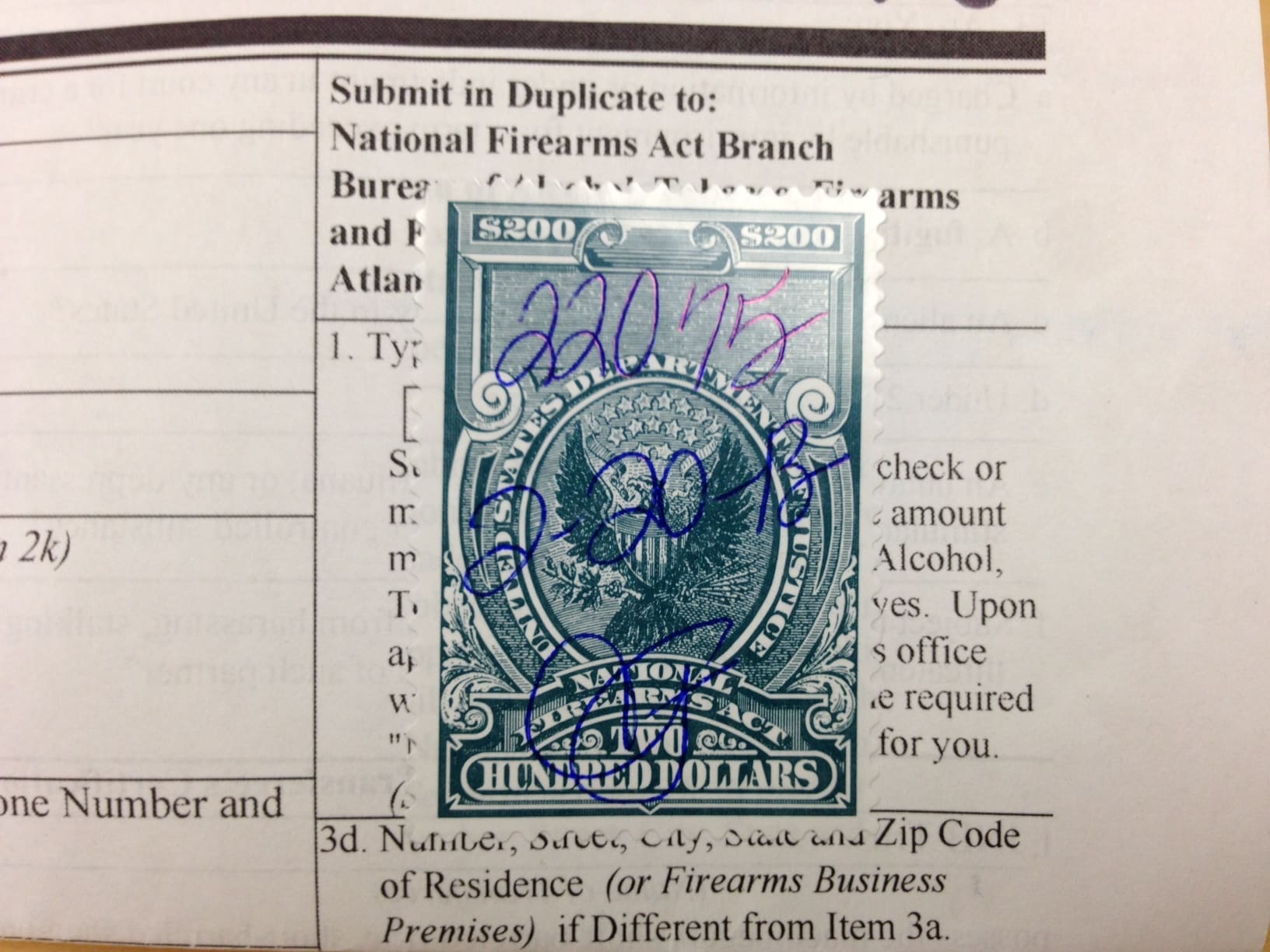

. Box 3c should contain your telephone number. The tax is 200 per firearm but it is only 5 for firearms classified as Any other Weapon AOW. Just called ATF 304-616-4500 and got it all explained.

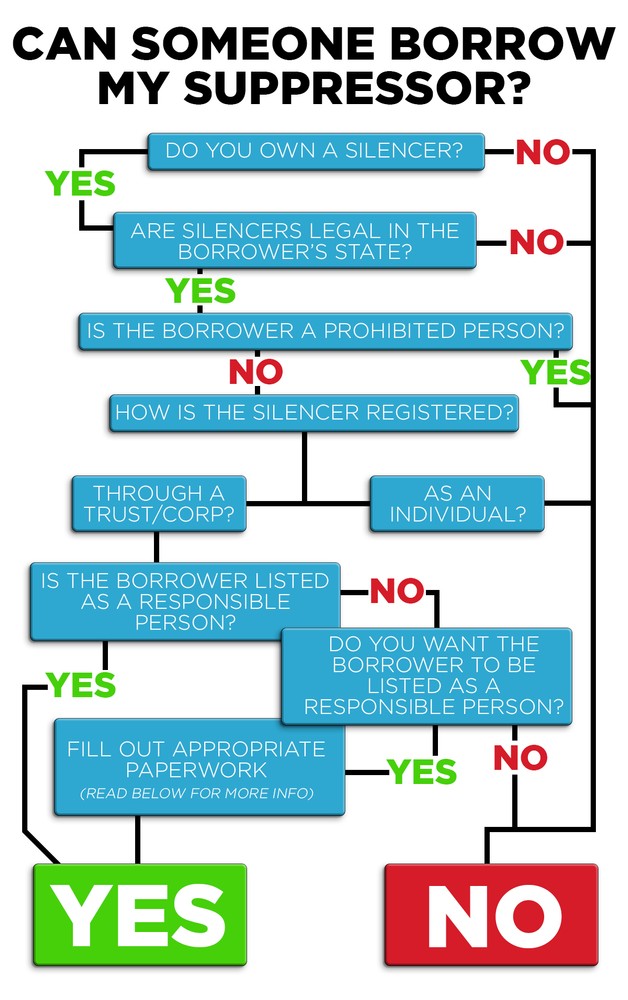

Interestingly the amount of. An individually purchased NFA item could only be legally possessed by the individual. 1 avoid fingerprints photos and CLEO approval 2 all trustees of the trust can possess the NFA firearms.

Are trusts still the best options for purchasing NFA-regulated items like suppressors SBRs and full-auto firearms. With 41-F in full swing and now that the ATF has caught up on ATF Form 1 and ATF Form 4 submissions with Post-41F laws you may be looking at purchasing NFA. Yes The Tax Stamp is for the ability to transfer a Title II firearms to an individual business entity or trust.

Submit fingerprints passport photo per usual process. Flexibility wise the Traditional NFA Trust falls somewhere right between Individual and Single Shots. Gun Trust NFA vs FFL.

But keep in mind if you buy your Silencer or SBR from an out of state retailer you will need to have it shipped to a gun store that is located in. In some situations a Form 4 is filled out using an NFA trust instead of as an individual. You can still use the NFA firearm while the 6 to 11 month approval.

Individual Purchase What is a trust. This means that if a group of individuals family andor friends are part of a trust then they all can share and have access to NFA firearms owned by the trust. Boxes 4a through 4h should be copied directly from the current individual tax stamp.

Purchase a suppressor add the 2495 Single Shot Trust product and a tax stamp and Silencer Shop does. This is likely due to the internal division of labor in the ATF and the fact that most NFA items transfer on trusts. Yes you can transfer your individual tax stamp into a gun trust corporation or other legal entity.

Use a revocable trust so that youre not transferring the NFA item. Sharing an individually owned NFA firearm is more problematic. Re-file every Form 4 and pay another 200 per stamp.

A trust could have multiple trustees each of whom could possess the NFA item. Moving a suppressor from an individual registration to a trust or corporation requires an additional 200 tax stamp. There is no discount or change in the Tax Stamp for a Trust.

It will be transferred to the trust AFTER getting the tax stamp. Instead if youre looking for something better than taking possession of an NFA Firearm as an individual you should look into getting an FFL. Hence the Single Shot moniker.

Box 3a should contain your name exactly as it appears on the current individual tax stamp and your current mailing address. If its a new trust and it does not own any NFA items yet just submit an empty Schedule A. The same thing is true in an NFA gun trust.

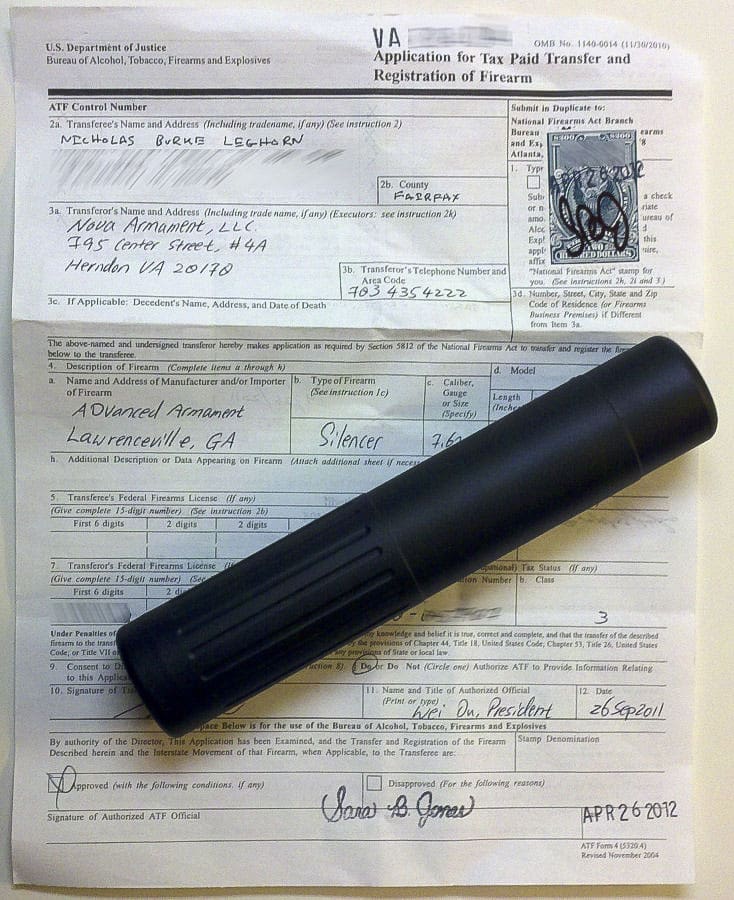

An individual NFA transfer on a Form 4 even if you use a trust requires a 10-month plus wait for ATF approval and the payment of a tax usually 200. The tax stamp is proof the NFA firearm was registered before it was sold or built. Put yourself as the transferor and your trust as the transferee.

Trustees can handle the item which is still owned by the grantor by virtue of using a fully revocable trust. If youd like to learn more about the Form 4 check out our ATF Form 4 Guide. Theyre at least 18 years old and that they havent committed a felony.

One DOES NOT list on Schedule A a firearm or receiver that is intended to be converted into SBR. A trust is a legal entity that can make it simpler for your family members business employees or shooting buddies to also enjoy NFA items. You have family andor friends you whole-heartedly trust with your entire selection of serialized items.

As an individual the wait time for a tax stamp on a Form 4 is 10 month or more. At the time of this writing individual Form 4s are transferring a couple of months faster than for trusts. Box 3b should contain your email address.

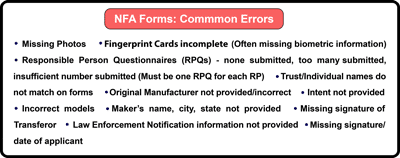

Create your NFA Gun Trust. Despite this limitation of co-trustee power the BATFE still requires that co-trustees who remain on the gun trust at the time of tax stamp. To obtain a tax stamp the applicant must submit ATF Form 53204 Form 4 or ATF Form 53201 Form 1 along with a tax payment.

Traditional NFA Trust is great for the customer who wants their trust to dictate who your silencer can be handled by during your life and after. A trust is far superior to individual ownership of NFA firearms for several reasons. In other words the examiners handling applications for individuals probably have a shorter workload.

Silencer Shop creates an NFA trust also often called a gun trust silencer trust suppressor trust that is tied to one NFA item and one NFA item only and is named for that item eg. It is illegal to possess an NFA firearm that is not registered to you. But if a trust buys a firearm any co-trustee can legally possess it.

In most cases the Tax Stamp is 200 but if you purchase an AOW the Tax Stamp is only 5. Say that on June 15th 2016- there were 200 trusts filings and 70 individual filings. Box 3d and 3e should usually be left blank.

The requirement of a tax stamp is triggered by a transfer Be careful because ATF treats foot-faults in compliance as if they were crimes. A firearms trust no longer makes sense to us. The ratio of trust to individuals would be different.

As an FFL using a Form 3 the wait time is usually only a day or two. If an individual buys a firearm only that individual may legally possess it. Trusts vs Individual Ownership Whether you purchase a suppressor as an individual or through a trust you submit your Form 4 and 200 for the tax stamp wait about eight months for your paperwork to clear and then you own your suppressor.

However since you are transferring the NFA firearm from one entity yourself to a different entity your gun trust corporation or other legal entity you will need to pay the ATF the 200 tax stamp again. Online wholesaler individual or other gun trust. I was agreeing that for the two form types to be at pace with one another more filings would have to be reviewed and processed to catch up to the amount of individual forms.

Keep in mind that its your responsibility to ensure the trustees can legally posses a suppressor ie. Upon death of the individual who owned an NFA item a little more legal gymnastics were required to legally transfer the item to a designated heir. When the trust is the lawful possessor of an NFA firearm then any individual who is the settlor or a trustee of that trust may lawfully possess that NFA firearm.

The 10 Steps required for getting your Tax Stamp are.

Atf Eform 1 Form 1 Efile Nfa Tax Stamp Process

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts

Atf Form 1 Guide Updated For 2021 Ffl License

Two Years After 41f Are Gun Trusts Still Worth It Nfa Gun Trusts

Ultimate Guide On What Is An Nfa Tax Stamp And How To Fill The Atf Eform 1 For Nfa Tax Stamp Application F5 Mfg

A Buyer S Guide Individual Vs Trust

Atf Tax Stamp Application Process Flow Chart National Gun Trusts

How To Carry Your Tax Stamp Copies Northwest Firearms

Nfa Tax Stamp How To Get A Suppressor Or Sbr Tax Stamp 2022 Rocketffl

Two Years After 41f Are Gun Trusts Still Worth It Nfa Gun Trusts

Constructive Possession Of Silencers And Nfa Firearms Red Hands Not Required The Truth About Guns

How To Buy A Suppressor Using An Nfa Trust The Truth About Guns

Who Is Allowed To Shoot Or Use My Silencer

Code Nfa Gun Trusts Storewide Sale 17 76 Off 1776 Discount Code Automatically Applied At Checkout R Gundeals

Passport Photos For Atf Tax Stamp Applications National Gun Trusts

How To Create Nfa Trust And E File Atf Form 1 For Suppressor Sbr Build Youtube